Paper Finance and the Social Security System 2016.10.14

The State of Operation of Local Tax Administration and Future Directions

Introduction

This paper discusses the future operation of local tax administration based on impressions from observation of local governments' tax administration, in preparation for a future of increasing use of information technology (IT) and decreasing numbers of local government employees.

In 2015, the environment surrounding local tax administration underwent massive changes. A system to support the self-sufficiency of the needy was implemented beginning in April, resulting in increased opportunities for local governments to use tax data. In October, residents were notified at last of their individual national identification numbers. The second report on regulatory reforms issued in June of last year included demands for promoting the sending of notices through electronic means and centralizing transaction inquiries with banks in connection with local tax, and it is likely that each of these will need to be considered in the future. These demands and new systems arose from the views of the national and local governments, private-sector firms, and residents concerning the inefficiencies of and possible further advances in the operation of tax administration and local government administration. In the future, demands such as these concerning operational processes are likely to increase more and more in number, as are revisions from the perspectives of improving operational efficiency and productivity instead of approaches based on tax theory and ideal forms alone. While such demands stem in part from the fact that technological progress in IT has made them feasible, they also can be said to be inspired by the fact that as numbers of local government employees gradually decrease in an increasingly aging society with low birth rates, efficiency improvements will be unavoidable.

Numbers of local government employees are decreasing. While in 1994 there were 9.37 such employees (not including educators, police, and fire department personnel) assigned to every 1000 residents, in 2010 the number had decreased to 7.31 persons. Many local governments refrained from hiring new employees after the collapse of Japan's bubble economy of the 1980s, and it is projected that their numbers will continue to decrease in the future. The decreasing number of employees means that local governments need to address the needs of residents, which continue to increase in number in an aging society with low birth rates, using even smaller numbers of employees than in the past. In addition to their normal duties working with taxpayers and delinquent payers, tax sections will face increasing responsibilities that require contributing to local government on a government-wide basis, such as operations related to supporting the self-sufficiency of the needy. Adoption of the national identification number system will increase the importance of tax data, probably leading to further increases in operations due to the need to ascertain data with greater precision not only for use in securing tax revenues but also as basic administrative data. Under the slogan of revitalizing local communities, expectations are likely to increase for tax sections which are responsible for collecting the taxes needed to fund various measures. However, there are limits to what human beings can accomplish 24 hours/day, 365 days/year. When considering the numbers of personnel likely to be assigned to tax sections in the future, it is hard to imagine that it would be easy to increase their numbers. Naturally, the ways in which taxation personnel do their jobs are expected to change in the future as well. Or rather, they are likely to need to change.

However, a time in which the roles and meaning of local tax administration expand due to massive environmental changes such as the adoption of the national identification number system is an excellent opportunity for tax sections to implement operational reforms. This refers to redesigning operations and advancing use of IT through appropriate management of the national identification number system and other new systems, to increase productivity through efficiency improvements. If preparations are made to ensure that staff can perform their duties efficiently and agilely at any time, then it should be possible to withstand further increases in the volume of tax information ascertained and decreases in staffing. Even if more personnel are assigned to important government-wide measures and core operations, they will be able to handle their responsibilities with flexibility.

This paper will consider operations that require redesign divided into the following stages: (i) the tax assessment stage, (ii) the tax collection stage, and (iii) the stage of identifying and processing delinquent taxes. A topic that should be redesigned at the (i) tax assessment stage is special collection of individual residents' tax. At (ii) the tax collection stage, redesign would involve development of an environment making it possible to pay taxes using mobile phones. Another topic for redesign at this stage would be to enable automatic checking off of payments within government agencies through advancing coordination with banks. In addition, while tax-collection channels have been developed that include remittance between accounts, paying taxes at convenience stores, and paying taxes by credit card, in order to spread the use of these channels even further it probably would be a good idea to reconsider fees with designated banks and credit-card issuers. At (iii) the stage of identifying and processing delinquent taxes, while progress has been made on centralization of collection and expansion to wider geographical areas of collection, means of further improving efficiency would involve e-garnishment and preparation of databases that could be used for profiling, through cooperation with banks. While further progress in local tax administration will require legal amendments in some cases, a large number of legal systems have been established in Japan during the postwar era, resulting in a highly complex system. To advance the task of legal amendments reliably, it would be preferable to create a database that can be used to understand the legal architecture. Doing so would make it possible to proceed with related tasks comprehensively without omission, for example by using IT to identify what other changes to the legal system would be required when amending one or more laws.

Of the above operations requiring redesign, this paper will look at redesign of special collection of individual residents' tax, e-garnishment and preparation of profiling databases and databases on legal architecture and other subjects, for all of which redesign in accordance with changes to the environment of local tax administration would be desirable.

1.Changes to the environment of local tax administration

(1)Adoption of the national identification number system

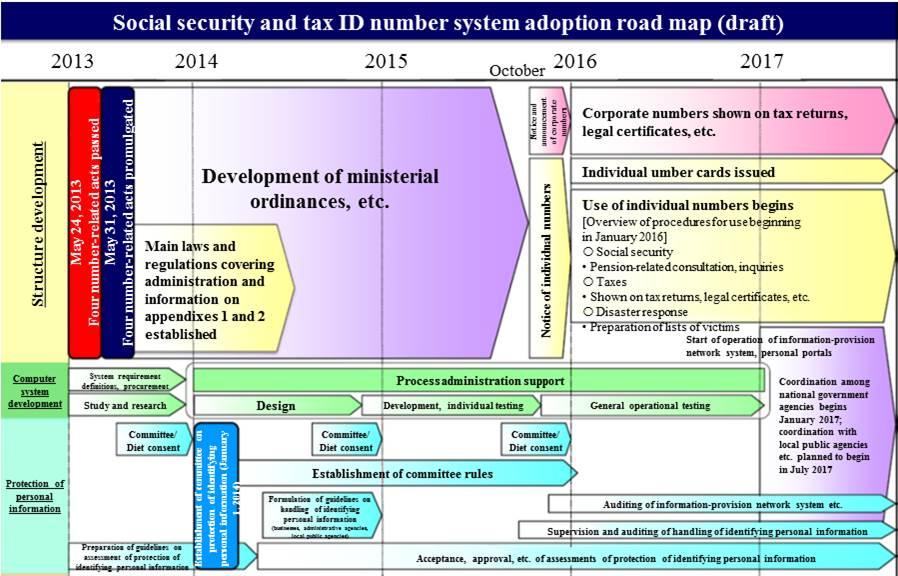

The national identification number system means "individual social security and tax ID number" system, which was established in May 2013 by the Act on the Use of Numbers to Identify a Specific Individual in Administrative Procedures (My Number Act; Act No. 27 of 2013). In October 2015, 12-digit personal numbers and 13-digit corporate numbers were assigned. Beginning in January 2016, plans call for indicating the numbers on individual residents' tax and salary payment statements related to income for the 2015 fiscal year and using them in connection with corporate business and residence taxes beginning with the 2015 fiscal year, and beginning inquiry and information provision services using an information network system in July 2016, with operation of a personal portal system slated to start in January 2017 (Fig. 1).

Adoption of the national identification number system is expected to have the effect of simplifying various procedures and making them more convenient. The report on the study group on local tax systems related to the number system, which met in the 2012 and 2013 fiscal years, stated that adoption of the number system would benefit both residents and administrators through means including shortening wait times in administrative offices and simplifying the task of identifying individuals and corporations.

(2)Second report on regulatory reforms (exchange of digital data and need for paperless system)

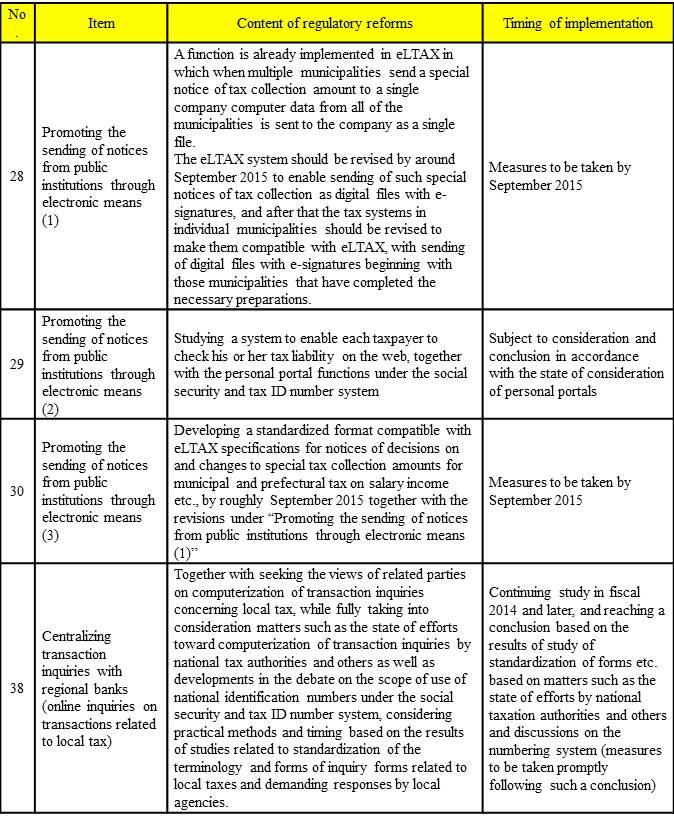

Following repeated study by five working groups on (i) health and medicine, (ii) employment, (iii) agriculture, (iv) investment promotion and other areas, and (v) community revitalization, the Council on Regulatory Reforms issued its second report on June 13, 2014, including demands related to local tax administration in areas such as entrepreneurship and IT (Table 1).

Its demands can be split into two main categories. One of these is promoting the sending of notices through electronic means, while the other is the centralizing transaction inquiries with banks. Promoting the sending of notices through electronic means involves three points: (i) Sending notices of amounts of tax subject to special collection as digital data with an e-signature; (ii) Making it possible for each taxpayer to reference tax amounts using his or her personal portal; and, (iii) Making it possible to exchange decision and change notices for special collection as digital data as well. In other words, this refers to shifting from exchange of paper documents and written inquiries to exchange of digital data, to achieve a paperless system. A paperless system would reduce the risk of loss or damage and lessen the needs for the labor of printing documents and the space needed to store them. Above all, use of digital data cuts time requirements.

On the other hand, centralizing transaction inquiries with banks refers to shifting to online deposit inquiries with banks. At present inquiries with banks are handled mainly in paper form, and what's more, document formats are not standardized, resulting in complex administration. In connection with local tax too inquiries are made to banks when investigating assets for disposition of delinquent taxes, and one regional bank has a four-person team working every day on handling inquiries from local governments involving asset investigation. This is a considerable workload. While local governments pay small fees, the bulk of the costs are covered by the banks. It would seem natural that banks would want to change this method to make it more efficient.

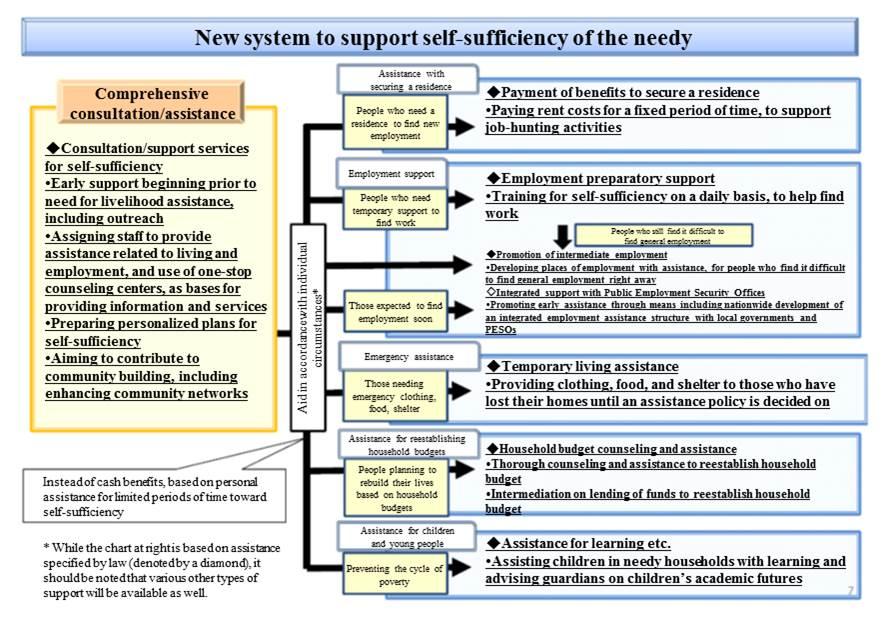

(3)The system to support the self-sufficiency of the needy

The system to support the self-sufficiency of the needy is a system intended to help the needy achieve self-sufficiency before they need livelihood assistance benefits (Fig. 2). Under this system, local governments will set up departments responsible in which case workers and self-sufficiency support counselors will meet with eligible persons one on one to work out support plans for self-sufficiency. Examples of specific support include (i) assistance with securing a home: payment of rent costs for a fixed period of time; (ii) employment assistance: job training; (iii) emergency assistance: provision of temporary clothing, food, and residences for those who have lost their homes; (iv) assistance with reestablishing household finances: counseling and lending of funds to help reestablish household finances; (v) assistance for children and young people: support for learning by children of needy households; and, (vi) other assistance and other programs. Taxation sections are requested to cooperate in the area of assistance with reestablishing household finances. Household finance counseling and assistance services include (i) help with preparing a household budget and balancing receipts and disbursements (using financial planners as necessary), (ii) support for eliminating delinquencies and using various benefits systems, (iii) support related to processing of obligations (accompaniment on visits to the Japan Legal Support Center and other support), and (iv) use of lending and other systems. The main support expected from taxation sections is the provision of tax information to facilitate these assistance activities.

As seen from general tax notice no. 11 ("Use of tax information in support for the needy etc.") under general administrative notice no. 29, dated March 3, 2011, it already is well known that use of tax information is important for ascertaining the actual circumstances of the needy. To help the needy achieve self-sufficiency, it is necessary to ascertain the fundamental cause of their situation, to determine whether it is due to unemployment, debts, or delinquencies in taxes and other charges, to prepare a plan for reestablishing the household budget, and to help them to achieve self-sufficiency in accordance with that plan.

Tax-collection sections are expected in the future to help prevent delinquencies so that they do not lead to further delinquencies. This assistance can be described as being part of such efforts.

This concludes this paper's review of the environmental changes affecting local tax administration. The following chapters will consider future management of tax administration, treating these changes as opportunities.

2.Redesign of special collection of individual residents' tax

At the tax assessment stage, special collection is the area in which the timing of the adoption of the national identification number system and the demands of the Council on Regulatory Reforms match best.

(1)Issues related to special collection

As demonstrated by the release by the national local tax council on August 22, 2014 of a statement on promotion of special collection of individual residents' tax, local governments have been focusing efforts on promotion of special collection of individual residents' tax recently. The Local Tax Act provides for special collection by the employer (the party obligated to conduct special collection) if it has one or more employee earning a salary income (taxpayer; not including cases such as when paying salary for up to two full-time household employees). Through now, the degree of such collection has reached a level of about 70% on a nationwide basis. Most local governments visit employers to request their cooperation, and often they will accept employer requests for use of ordinary collection instead, so that even though in principle special collection is to be used, the position of local governments is weak in such cases. Since this state of affairs has continued for a long period of time, local governments' tax assessment staff are not eager to promote special collection.

There is a need to consider here the reason why special collection is used in only about 70% of cases even though it is prescribed by the Local Tax Act and local government staff encourage its use. This is because the system of special collection does not match the actual conditions of employers and local governments. The system would be put to greater use if it were redesigned in a way that would be considered reasonable.

The reason businesses do not want to be obligated to conduct special collection is due to the complexity of administration. They must complete separate procedures for each local government assessing taxes, and in some cases, they need to revise fees on tax payment or their payroll systems, requiring considerable time and expense. Some argue that it is even more troublesome for those with small numbers of employees. It also has been pointed out that some industries have large numbers of short-term part-time or hourly employees and complex procedures are involved when employees leave or join an employer. This is why local governments have tended to accept employers' requests to use ordinary collection, and it is apparent that both local government staff and employers tend to think mistakenly that this is an elective system. Some local governments even include a space on the salary payment report (summary form) for choosing whether or not to request ordinary collection.

Local governments are troubled by concentration of special collection-related operations. Local governments are busy with initial tax assessment from February through May, facing a massive administrative workload during this period. They overcome this load through means including borrowing staff from other sections and temporary hiring, and they seem to consider this a situation that cannot change due to the predetermined volume of operations. Another difficulty they face is that concerning storage space for large volumes of documents. They number the documents and file them in order. If they receive an inquiry after the initial tax assessment, they go to the storage location and peruse the relevant documents in preparing their response. Furthermore, local governments also print out salary payment reports and send them to the relevant employers, but many employers simply dispose of these without using them, so that the effort of printing them is wasted.

In addition, recently in increasing cases employers conducting special collection are delinquent in payment, eventually resulting in disposition for failure to pay. There is an increasing need to prevent such disposition before it arises in the future.

(2)Redesigning special collection

In light of such institutional fatigue, the adoption of the national identification number system presents an excellent opportunity for redesigning special collection. A prerequisite for doing so would be the elimination of use of paper. Basically, salary payment reports should not be printed and sent.

(i)Step 1: Introduction of wide-area reception centers

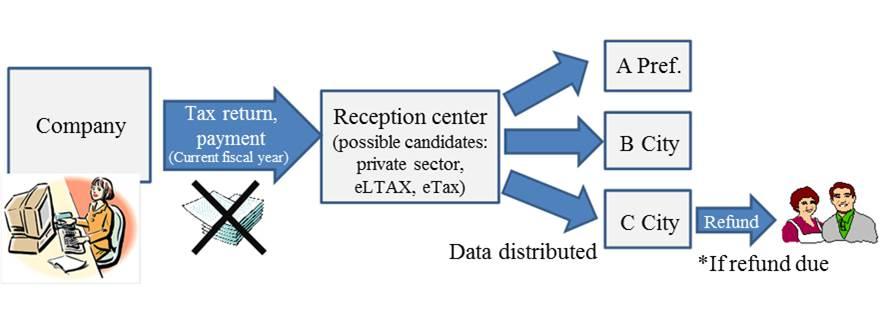

Employers have business facilities across Japan and in multiple regions, and they have employees who commute from multiple local government jurisdictions. While income tax must be paid only to a single place, the National Tax Agency, local tax must be paid to each local government where employees live, resulting in complex administrative processes. Accordingly, it might be a good idea to introduce wide-area reception centers that would accept payment and submittal of materials and distribute the relevant data to each local government. One proposal for doing so would involve setting up reception centers that could handle national tax matters as well.

(ii)Step 2: Tax assessment for the current year together with withholding tax

Withholding tax and special collection are similar in that the employer pays tax on behalf of the employee. Income tax is withheld at the source and then tax is finalized through year-end adjustment or filing an income tax return. Residents' tax differs from income tax in that it is assessed in the following fiscal year instead of being paid by self-assessment. Withholding of income tax at the source is an efficient system, even though employees are not highly conscious of the fact that they are paying taxes and it would be difficult to say that it truly is based on self assessment. It might be a good idea for residents' tax too to employ the approach of collecting it based on estimated amounts and adjusting amounts during the current fiscal year (with municipal governments calculating tax amounts based on salary payment reports submitted by employers, in the same way they do now), with any excess payments refunded in the following fiscal year.

It has been pointed out before that one of the major causes of delinquencies in payment of residents' tax is the fact that local tax is assessed in the following fiscal year based on income during the preceding year. If it were to be withheld at the time of payment of salary, then the number of residents who become delinquent in the following fiscal year because they do not save any of their salary or retirement benefits for payment of residents' tax due to a misunderstanding of the system would be likely to decrease (Fig. 3).

(3)Review of local government operations

Regardless of whether or not steps 1 and 2 above are carried out, it would be recommended to review local government operations related to special collection in the event of such a major change as the introduction of the national identification number system. This refers to changing from an operational flow based on paper to one based on data.

The need to manage large volumes of paper documents over several years leads to issues of storage space and complex operations that constantly involve the risk of loss or damage. Processing paper documents using bar codes (national identification numbers) and scanning them to digital format would make it possible to separate document admiration from ordinary operations. It would make it possible to reduce greatly the risk of loss or damage and to simplify operational flows. There also would be no need for numbering and filing paper documents.

In addition, after notification of the final tax amount special collection involves increasing volumes of handling by telephone, but such handling is difficult for staff due to the prevailing belief that it cannot be conducted unless one understands all related operations. In general, the staff member taking the phone call puts the caller on hold temporarily to check the matter, walking to the shelf where the paper documents are stored and checking them before responding. That is, all tasks from answering the call to investigating the matter and responding are handled by a single individual, resulting in complex operations that involve leaving his or her desk.

It would be possible to release staff from this task as well. (i) Numerous staff could be assigned to handle large volumes of inquiries through sorting residents' inquiries by their content, using an interactive voice response (IVR) system or a main switchboard to transfer calls by their content. (ii) By converting paper documents to digital format and loading them to tax workstations, staff will not need to leave their desks but instead could handle telephone inquiries completely from their desks. (iii) Storage of paper documents in warehouses would greatly reduce risks of loss or damage and make it possible to use workspaces more effectively.

Through this method, it would be possible to prepare staffing to handle telephone calls quickly without requiring comprehensive knowledge of all operations, so that even large volumes of calls could be handled with flexibility. It would be desirable to design operations so that staff could be assigned to tasks as needed.

3.Electronic garnishment of monetary claims (e-Garnishment)

Next, this paper will propose operations to improve efficiency at the stage of processing and disposition of delinquent taxes. This takes the demands of the Council on Regulatory Reforms one-step further.

The Council on Regulatory Reforms demanded the shifting online of transaction inquiries on local tax conducted with banks. One regional bank has a four-person team working on requests from tax offices and local governments for asset investigations every day. In light of the considerable costs involved, it would be desirable to shift to an online system, but it would be preferable to take this a step further to enable computerization of not just transaction inquiries but electronic garnishment of monetary claims as well (e-garnishment). In the United States, the state of North Carolina uses e-garnishment. In Japan, Higo Bank has begun centralized garnishment through exchange of information with local governments through digital media. While this cannot be called e-garnishment, it is a very similar approach. This year, a number of regional banks plan to begin similar initiatives. With the recent availability of ATMs at convenience stores, such as those of Seven Bank at 7-Eleven stores, it has become possible to withdraw funds faster than local government staff can make it to bank branches. Garnishment too needs to adapt to such environmental changes.

In the case of Higo Bank, the bank began centralized garnishment after consulting with Kumamoto Prefecture in the face of the increasing burden of operations in dealing with local government staff from Kumamoto Prefecture and other local governments who came to bank branches for purposes of administration of garnishment of deposits. At present, Kumamoto Prefecture and some local governments within the prefecture bring to Higo Bank's administrative center data on subjects including notices of garnishment of claims and delinquent taxpayers' accounts to have the data reconciled and then garnishment on the relevant accounts implemented automatically. While delinquent taxpayers with obligations to Higo Bank in forms such as home mortgages and educational loans are not covered by this system, their cases can be handled in the previous manner by visiting the bank branches. At the very least, the need to visit the branch each time has been eliminated and garnishment made more reliable, so that this case is likely to attract the attention of numerous local governments and regional banks in the future.

4.Use of Big Data: Profiling and legal amendments

(1)Development of a profiling database

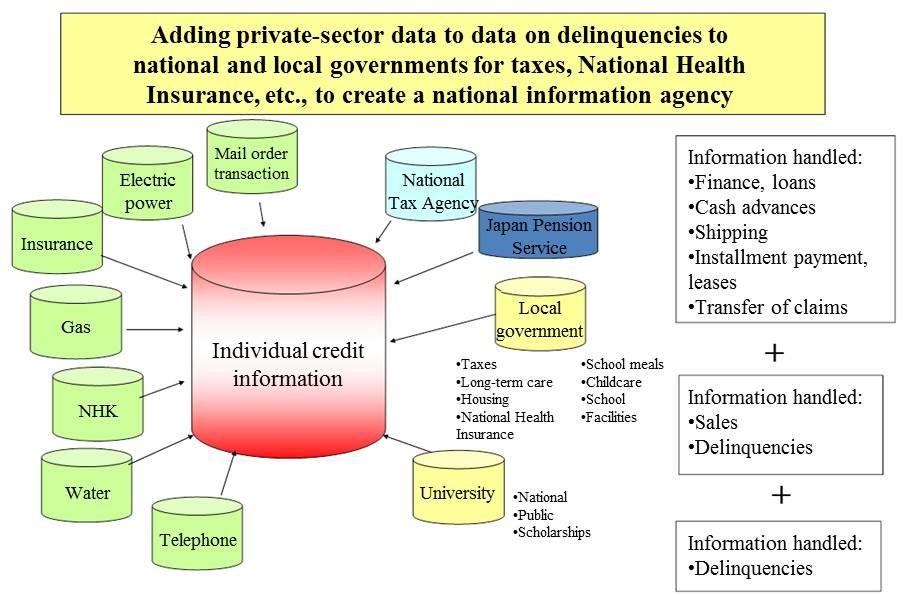

Advances in information technology in recent years have made it possible to process Big Data. Taxation operations involve processing of large volumes of information. This too is one type of Big Data. While to local governments tax information is valuable data used in various ways to secure funding, at present they are not putting it to full use. Integrating this tax information with data in the possession of local governments on subjects such as household registers, National Health Insurance, long-term care, housing, and childcare, using national identification numbers as keys, would make it possible to profile delinquent taxpayers. Analysis of a wide range of combinations of data such as gender, occupation, locale, annual income, age, and date of becoming a resident could be used to identify where to focus attention, so that processing and disposition of delinquencies could be carried out more efficiently.

Furthermore, as shown in Fig. 4 it might be possible to realize more appropriate tax assessment by ascertaining taxpayers' consumption patterns through addition to these data of various types of Big Data. The ability to analyze the characteristics and behavioral patterns of delinquent taxpayers could make it possible not only to secure payment of delinquent taxes but also to prevent delinquencies before they arise. It might even make it possible to identify tax evaders.

(2)Development of a regulatory architecture

As of July 2014 the Japanese legal system consisted of a total of 1950 laws in effect. Of these, 86 laws were enacted in 1945 or earlier and still remained in effect, while the bulk of the remainder were enacted in large volumes either soon after the end of World War II or around the year 2000. At the same time new laws are being enacted in this way, existing laws are being amended as well. Some are amended for purposes of keeping them up to date while others are amended for purposes of revising their content. When enactment of a new law required amendment of other related laws, a single law could end up involving amendment of numerous others. The Comprehensive Decentralization Act in 1999 involved amendment of more than 1000 Acts when all of these are included , and since 2000 more than 200 legal amendments have taken place each year with the exception of the period around the time of the global economic crisis.

While in many cases further advances in local tax administration will require legal amendments, since the text of laws is written in accordance with certain unique rules and laws interact with each other in complex ways, it is difficult even for practitioners such as national and local governments and attorneys, let alone members of the general public, to understand the relations between laws.

Steady progress on legal amendments requires looking at a wide range of laws, but under current conditions there are limits to the extent to which this is possible. Occasionally there has been talk about laws written in error. The task of amending laws is difficult under such complex conditions. Accordingly, it might be possible to eliminate such errors in writing laws through development of a database showing the interrelations among laws and their architecture, in a format resembling XBRL. This should make it possible to proceed comprehensively without omission with legal amendments because IT could be used to learn which parts of other laws would need to be changed if part of one law changes.

Conclusion

This paper has discussed future management of local tax administration based on observation of local governments' tax administration with an eye toward future advances in IT and reductions in local government staffing. At the time of efforts toward local e-government around the year 2000, the objective was infrastructure development, but it could be said that from now on will be a time for improving the efficiency of local tax administration under an IT-based environment. Since tax administration involves large volumes of data, design of operations using IT could improve efficiency and productivity. To carry out local tax administration in accordance with contemporary needs, it is essential to use the latest technologies available at any point in time to revise related systems in reasonable ways, while listening to the views of local government staff, employers, and residents. There remains room for further advances in local tax administration.

(This article was translated from the Japanese transcript of Dr. Kashiwagi's paper.)