Column Finance and the Social Security System 2016.06.23

Additional financial resources hidden in social welfare corporations

In order to raise the economic growth rate in Japan, where the total overall population has been decreasing as well as the working age population, it is vital to enhance the employment rate of women. Women with a desire to work, however, have not necessarily been able to find a job, mainly due to a shortage of nursery and elderly care facilities. Social welfare corporations play an important role in nursery and elderly care service delivery in Japan. It is said that the shortage of those facilities is due to low salaries of childminders and caregivers which are 20% ~ 30% less than the national average. As part of its economic growth strategy, the Abe administration has committed itself to raising the salaries of childminders and caregivers and the financial resources for raising their salaries have become an important policy issue. The Canon Institute for Global Studies (CIGS), therefore, last March announced the results of an estimation of the entire financial structure of social welfare corporations. Since the report has revealed the fact that they hold available financial resources to increase employee salaries, public debate on the issue has grown. The main points are explained here.

The social welfare corporation system was established in 1951. They are private non-profit entities to support the socially vulnerable such as infants, the elderly, people with disabilities and the needy. There are more than 20,000 social welfare corporations, about 18,000 of which operate care service facilities. Since most of them are founded as family-run entities 70% of them are small institutions with an annual revenue of less than 400 million yen. The government has continued to give them extensive subsidies and tax breaks. Nevertheless, the government has never, up to now, aggregated financial data across the industry. This can be called "Negligent work of public office", with the result that their financial situation is unknown.

As a result, CIGS collected and analyzed the financial statements of about 1,200 social welfare corporations in 2011, pointing out the fact that huge internal reserves had been accumulated. The CIGS report led to the Social Welfare Law Amendment, which was passed by the Diet in March 2016. One of important points in the amendment is that all social welfare corporations are required to disclose financial statements, with which the government can establish a national database. The aggregation published last March is the CIGS's second estimation. Its main purpose is to accelerate the speed of reform by overviewing the financial structure of the social welfare industry in advance. It should be noted that the second estimation does not include Saiseikai Imperial Gift Foundation (2014 annual revenues: 582 billion yen) and Seirei Social Welfare Community (Ibidem: 105 billion yen), because their scale is far larger than others and they have published detailed financial statements for a long time.

There were 23,537 nurseries as of 2015. Classifying them in terms of type of management, social welfare corporations (12,382) and local governments (9,212) are the overwhelming majority, while the number of nurseries operated by for-profit corporations is still small at 927. There are various types of facilities for the elderly, such as special nursing homes, paid nursing homes, elderly health facilities, group homes for dementia, and assisted-living homes. The combined total of bed capacity was over 1.8 million as of 2014. Among them, the largest share of total bed capacity was held by special nursing homes operated by social welfare corporations with 539,000 beds.

Since CIGS pointed out the huge amount of internal reserves they held in 2011, the associations of social welfare corporations have repeatedly disputed the findings by saying that most of their internal reserves have already been converted from financial assets to fixed assets and that their profit rate is low because they do not target profits, unlike stock corporations. Therefore, CIGS collected the financial statements of 5,513 social welfare corporations this time and focused on operating profit rate and net financial assets (gross financial assets minus outstanding loan minus retirement benefits reserve) by main facility type as well as by prefecture. A summary of the results are as follows.

(1) We can recognize the social welfare corporations that are continuing to invest in the new facilities to meet various social welfare needs by borrowing money. However, these exemplary management entities are in the minority. Most social welfare corporations are reluctant to respond to new needs.

(2) In order to estimate the financial data of the total 18,000 corporations which operate care service facilities (excluding Saiseikai Imperial Gift Foundation and Seirei Social Welfare Community) CIGS assumes that the average business scale of the remaining corporations is one third of 5,513 corporations whose data was collected by CIGS. The results are, Total assets: 18 trillion yen; Net financial assets: 2 trillion yen; Total revenues: 7.6 trillion yen; Operating profits: 330 billion yen; and Average operating profit rate: 4.4%.

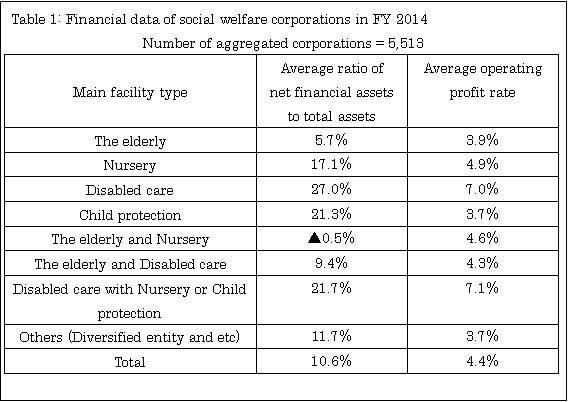

(3) The large disparity in the ratio of net financial assets to total assets and operating profit rate has been confirmed by main facility type (Table 1) and by prefecture. Notably, the social welfare corporations that specialize in facilities for disabled people have held 27% of the average ratio of net financial assets to total assets and 7% of the operating average profit rate. They hold enough financial resources to raise employee salaries and improve services for those with disabilities.

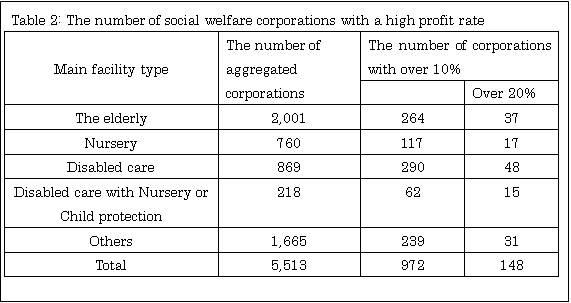

(4) Of the 5,513 social welfare corporations, the number of corporations with over 10% operating profit rate is 972, including 148 with over 20%. (Table 2)

(5) Operating profit rates in local areas tend to be higher than those in big city areas like Tokyo, mainly due to lower wages.

Social welfare corporations are the organizations that should play a central role in the safety net system for the people of Japan. Their current governance system, however, is so vulnerable that the supervisory function of government agencies does not work. For example, although the Ministry of Health, Labour and Welfare tried to collect the FY 2013 financial statements of 20,000 social welfare corporations, about 7,000 could not be aggregated due to poor data reliability, including unbalanced sheets in which the debit did not match the credit. This kind of poor record-keeping defies common sense. For over 60 years the government has given such entities extensive subsidies and preferential treatment in regards of corporation tax. The Social Welfare Law Amendment 2016 can be called "Radical Reform" to correct the defects of the current system.