Media Finance and the Social Security System 2016.05.10

Japan's Economic Outlook

1. Near-term Economic Trends

A full three years have passed since the Abe administration came to power, yet the outlook for economic policy is becoming increasingly difficult to understand. In April of 2013, when Governor Haruhiko Kuroda began the bold monetary easing policy known as "quantitative and qualitative monetary easing," he set the goal of "achieving 2% inflation in about two years." If things had gone according to that target, there would have been 2% inflation in the spring-summer period of 2015, but recently the rate of inflation became negative, and 2% inflation seems a long way off. Mr. Kuroda has approved the stance that the latter half of 2016 will be the deadline to achieve this, yet many market participants are skeptical of achieving 2% inflation anytime within 2016. The government has set an economic growth rate target of 2.3%, but during the past three years of the Abe administration, there has been an average of 1% growth and most recently this has even become negative growth. The economic recovery that Abenomics envisioned is currently not proceeding as planned. Moreover, according to the reference date of the business cycle determined by the Cabinet Office, the business cycle was in a trough one month before the Abe administration took office (November 2012), meaning that business recovery has continued since that point in time. However, three years have already passed. Since the period spanning from the economic trough to the economic peak has mostly been about three years during the past business cycles, it wouldn't be unusual to start moving away from the economic peak this year if we consider the situation at the point in time of January 2016. If that is the case, that would mean there is an increasing possibility from this year to next year of the economy entering into a recessionary phase, and under such an environment, one can say that exiting from deflation and achieving economic growth is not going to be simple.

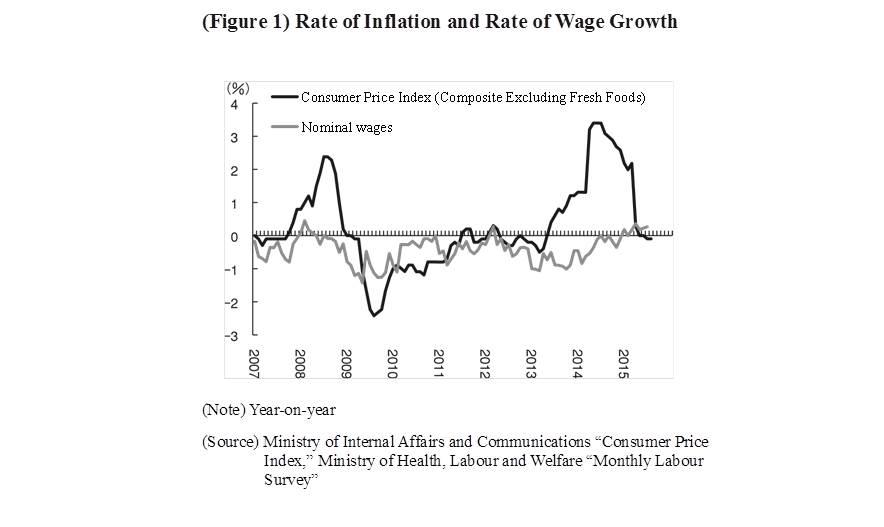

One reason why the economy remains weak is that workers' wages have substantially declined under the Abe administration. Figure 1 is a graph that compares the rate of inflation to the rate of wage growth.

For the past three years, the country was unable to achieve the target of 2% inflation, but the consumer price index (including the increase in consumption tax) has largely achieved around 1% of positive inflation. Additionally, due to the increase in consumption tax in April 2014, the commodity price including consumption tax from the perspective of consumers has seen inflation of more than 2% (the Bank of Japan's target of 2% inflation is for the commodity price without consumption tax). In particular, the increase in prices on foods and daily necessities has been remarkable, and this is putting pressure on the living standard of workers. However, the rate of increase in nominal wages until the middle of 2014 went from a negative 1% to hovering around approximately 0%. The rate of wage growth has finally recently started to move towards positive growth. In other words, even though the commodity price has slowly been increasing, the state of wages not rising is continuing. Substantially, this is the same as if wages were decreasing by a rate of 1% - 2%. With this we can say that far from improving, the living standard of workers has been worsening. If wages start to rise at a rate that is the same as the rate of inflation or greater, personal consumption can truly recover. For Japan to steadily recover and have strong economic growth as well, growth in wages is an extremely important issue.・・・

Japan's Economic Outlook (PDF:461KB)

(This article was translated from the Japanese transcript of Dr. Kobayashi's column.)