Introduction

The Trans-Pacific Partnership is intended to greatly liberalize trade by, among other policies, eliminating all tariffs between partner nations. Nevertheless, our legislature, specifically the Agriculture, Forestry and Fisheries Committee, is demanding that Japan be allowed to keep its tariffs on five agricultural products including rice, wheat, beef, pork, dairy products, and sugar. The Diet Committee has indicated it would not hesitate to end Japan's participation in TPP talks if the other TPP nations refuse to make an exception for Japanese agriculture. This threat has tied the government's hands. Despite the fact that the combined value of the yearly output of these protected products, four trillion yen, is 1/13th the value of annual automotive production in Japan, agricultural interests are controlling Japan's TPP agenda.

Japan's insistence on protecting its agricultural markets will lead the United States to keep its tariffs on Japanese automobiles for the foreseeable future. At the same time, the US-Korea Free Trade Agreement has eliminated US tariffs on Korean cars. Japan is wasting an opportunity to improve the conditions of competition for Japanese automakers in the US market to match that of their Korean automakers. Moreover, a growing number of US Congress members are calling for Japan to be excluded from TPP negotiations because of its insistence on protecting numerous agricultural products.

Are High Tariffs in Japan's National Interests?

The OECD has devised a measure, the Producer Support Estimate (PSE), of how much money is transferred from consumers and taxpayers to farmers as a result of agricultural protection policies. For instance, when people must pay more for a product than the international market price, the additional amount paid is an income transfer from consumers to farmers. The PSE consists of consumers' burden and taxpayers' burden. In 2010, the share of consumers' burden in PSE in the United States was six percent and that in the EU was 15 percent, nowhere near that in Japan- 78 percent (approximately 3.6 trillion yen). While the US and the EU governments provide farmers with income support through direct payments, Japan relies primarily on price-support schemes to protect its farmers. Because the domestic prices are much higher than international market prices, it takes high tariffs to bring the price of imports up to domestic price levels.

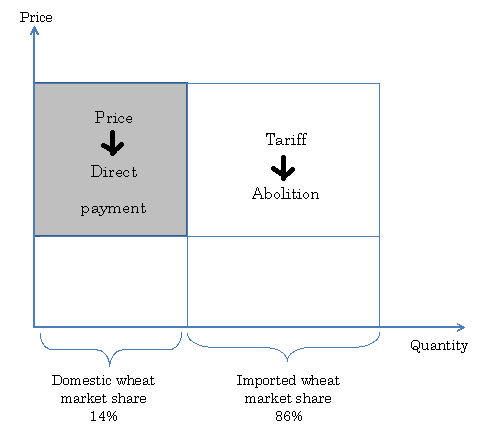

In the name of the national interest, the government imposes tariffs to maintain high prices for agricultural products and foods. In the case of wheat, for example, domestically grown wheat accounts for only 14 percent of the wheat consumed in Japan. To protect the growers of that 14 percent, tariffs are placed on the other 86 percent that is imported, forcing consumers to pay inflated prices for bread, noodles, and other products. Policymakers are starting to consider lowering the consumption tax on food because it is a regressive tax which imposes a heavy burden on poor people, but politicians continue to claim that the tariffs that are driving up food prices are serving the national interest.

Critics of the TPP argue that switching from using tariffs to bridge the price difference between domestic and imported farm products (consumer financed) to making direct payments to farmers (taxpayer financed) would require a massive amount of government spending. This claim can only be regarded as a frank admission that consumers are already paying a massive amount to support farmers. Moreover, as in the case of wheat, consumers are paying inflated prices not just for domestic products but for imported ones as well, making their actual burden larger still. Eliminating tariffs and introducing direct payments to farmers to compensate for the difference between prices for domestic and imported products would save consumers a great deal as they would no longer be forced to pay above international market prices for imported as well as domestic products.

Taxpayers already pay 400 billion yen to rice farmers annually for setting aside acreage to reduce production. These set-asides raise the price of rice, pushing the total burden to consumers above 600 billion yen per year. Japan's annual rice production is valued at two trillion yen. The Japanese people, as taxpayers and consumers, pay a total of one trillion yen each year to support domestic rice farmers. If the government abolished the acreage set-aside program, and instead paid compensation to farmers (whose primary source of income is farming) if rice prices subsequently fall, the government would then need to spend a relatively modest 200 billion yen to support rice farmers. In addition, consumers would no longer have to endure prices made artificially high through the acreage set-aside program. The combined cost to taxpayers and consumers would shrink from one trillion yen to 200 billion yen.

The Agricultural Cooperatives and Policies Obstructing Agricultural Development

In Japan, there is an impediment to changing from price supports to direct payments that does not exist in the United States or the European Union-- the Japan Agricultural Cooperatives (JA) that depends heavily on high rice prices. Under the JA's rules, the vote of a weekend farmer counts as much as the vote of a large scale farmer. The "one person, one vote" system made sense in the early postwar era, when land reforms aimed at transforming tenant farmers in each village into owners of simillary-sized plots of land. The JA helps to turn out the rural vote for the Liberal Democratic Party which repays the favor with rice price supports and various subsidies.

Figure 1: Comparison of the effects of wheat price supports and direct payments

Income is revenue, which is price multiplied by quantity minus costs. Increasing income requires either raising prices, raising yields, or lowering costs. In the past, when the government bought rice under the "food control system," the JA mobilized its members in a major campaign to increase rice prices. In 1995, the food control system was abolished. The government today only buys small quantities of rice to keep in case of emergency. The JA has worked to keep prices high by limiting the supply of rice by taking land out of production under acreage set-aside programs.

The unit cost of growing rice on a 15 hectare farm is less than half what it costs to grow rice on a .5 hectare farm. The unit cost of growing rice on a given farm is calculated by dividing the total cost of inputs, such as fertilizer, agrochemicals, and machinery, by the yields. If the yield doubles, the unit cost is halved. In other words, farmers can increase their incomes without raising prices through economies of scale and higher yields. People who farm part-time, or as pensioners, with farms smaller than one hectare earn practically nothing from farming. However, if a group of villagers owned a total of 20 hectares and delegated all the cultivation to one person, the annual income from the resulting crop would be 14.5 million yen. It would be more lucrative for villagers to jointly lease their land in return for a share of the lessee's income than for each family to farm its own land.

Increasing the average farm size would of course mean a reduction in the number of farm households given that the amount of land is essentially fixed. The JA is well aware that its political clout is dependent on the number of farmers it represents and has no interest in seeing that number fall. The JA therefore demanded price supports for rice and opposed fundamental agricultural reform and rationalization as a means to increasing its members' income. As the JA had envisioned, high rice prices motivated part-time farmers to continue growing rice inefficiently in their tiny plots and to avoid relinquishing their property.

Part-time rice growers, who now account for 70 percent of all farm households, tend to deposit their earned income and gains from sales of their land for residential use and other non-farming uses in banks run by the JA. With 90 trillion yen in deposits, the JA bank is one of the leading megabanks in Japan.

People who wanted to grow rice on a larger scale to increase their income struggled to buy or lease enough land to farm efficiently. Evidence of the distorting effects of high rice price supports can be found in the percentages of farm products that are sold by full-time farmers; 80 percent of vegetables, 93 percent of dairy products, but only 38 percent of rice is produced by full-time farmers.

Rice acreage set-aside programs have also impeded advances in crop yields. If overall consumption levels are fixed, increasing yields means that fewer acres of rice paddy are needed, which increases the acreage eligible for set-aside programs and the amount the government pays to farmers for taking their land out of production. As a result, after the set-aside program was introduced in 1970, government-affiliated research institutions regarded developing higher yield strains of rice as taboo. The rice grown in Japan has 40 percent lower yields than rice grown in California. A private company has developed a variety of rice with yields higher than California rice, but the fear of larger rice harvests driving prices down has kept the JA from accepting it.

The high price supports for rice and the set-aside programs have cut rice consumption and production. The total value of rice grown in Japan fell by half over 10 years. Without tariffs, it would be impossible to continue the set-aside program that keeps the price of domestic rice higher than imported rice. If the government used direct payments to aid farmers, they would be unaffected by price declines. However, getting rid of tariffs would effectively end part-time farming as larger scale farms gain the advantages of scale. Ending part-time farming would lead to a steep loss of members for the JA that would shake the organization to its core. This is why the JA has organized an extensive campaign against the TPP. The JA extracts promises from rural Diet members to oppose joining the TPP and abolishing agricultural tariffs as conditions for receiving the JA's help in getting elected. Instead of the trade agreement controversy being a "TPP-agriculture problem," in reality it is a "TPP-JA problem."

Why Japanese Agriculture Needs the TPP

The farm lobby in Japan argues that Japan's farms are too small to compete with the farms of the United States and Australia. The average farm in the EU is six times larger than in Japan. Average farms in the US and Australia farms are 75 and 1,309 times bigger, respectively.

Larger scale usually means lower costs, but size is not the only factor. If that were the case, then the US, the world's leading agricultural exporter, would be unable to compete with Australia given that its farms are 17 times larger than American farms. In reality, factors such as soil quality and climate outweigh Australia's farm size advantage. Whereas fertile soil in the US will support soybean and corn farming, Australia's less fertile land is better suited to livestock grazing. The fact that Australian wheat farmers grow only 1/5th as much wheat per acre as their UK counterparts testifies to the poor quality of Australian soil. EU farms are drastically smaller than farms in the US and Australia (1/12th and 1/218th, respectively), but due to high crop yields and direct payments from the EU, the EU agricultural industry is able to export grain.

There is also the issue of quality. As in the case of automobiles, there is demand for luxury products as well as cheap products in the global agricultural market. A given farm product can be available in a wide range of quality levels. Rice grown in Japan has a reputation for high quality. In Hong Kong, koshihikari rice from Japan sells at a price 1.6 times higher than koshihikari grown in California and 2.5 times higher than koshihikari from China. If Japan's rice production rose to the point where it could be priced competitively, Japan's farmers could capitalize on their widely recognized quality advantage.

Japan's domestic rice market, long protected by high tariffs, is now contracting as the population ages and declines. To keep Japanese agriculture from falling further or, more ambitiously, to revive it, there is no choice but to break into overseas markets. Bringing down costs will not lead to higher sales if Japan's farm exports are subject to high tariffs abroad. If Japan fails to fully commit to trade liberalization initiatives such as the TPP that will eliminate tariffs, then Japanese agriculture will be trapped in its downward spiral.

The most promising export market for Japan is of course China. Currently, China applies a 1 percent tariff to Japanese rice imports. However, a kilogram of rice that costs 300 yen in Japan is sold for 1300 yen in Shanghai. The beneficiary of this huge markup is the Chinese state-owned enterprise (SOE) that has a monopoly on rice distribution. As long as such de facto tariffs exist, exports will remain restricted.

Although China is not participating in the TPP talks, one of the United States' long-term goals for the TPP is to use it to pressure China to eliminate barriers to free trade created by its SOEs. Vietnam, another socialist nation with SOEs, is serving as a stand-in for China in negotiations. If China were to eventually join the TPP, it would have to accept the same state-owned enterprise rules as Vietnam. If Japan were to negotiate directly with China, it would lack the leverage to convince the Chinese government to limit its SOEs' obstruction of free trade. Japan's only option is to work with the United States to develop rules to constrain SOEs. Participating in the TPP talks gives Japan an opportunity to break into the Chinese market.

Conclusion

The development of Japanese agriculture is being blocked by farm policies such as rice acreage set-aside programs. However, as long as the JA has both great political clout and monopolistic market power, there is no chance that set-aside programs will be abolished, that other fundamental farm policy reforms will be enacted, that exports will increase, or that Japan will really engage in TPP negotiations. Having identified the TPP as an important part of its economic growth strategy, the Abe administration has begun working toward a systemic reform of the JA, the organization which had kept Japan out of the TPP process.

Continuing to use tariffs to keep the price of farm goods high will further damage Japanese agriculture and hurt consumers. Bold action to reform agriculture is necessary to ease the burden on poor people by lowering prices and to revive farming in Japan. There is no other way to reverse the decline of Japanese agriculture.